Even a small-scale M&A transaction requires data verification, analysis, and the negotiation process that may take days. When it comes to industry giants acquiring large-scale businesses, the process may take weeks or sometimes even months. On top of that, there may be negative outcomes if there are communication barriers and insufficient access to business documents.

However, these hindrances can be minimized using virtual data room software. The application of virtual data rooms is not something new in mergers and acquisitions, as VDRs were first used for this very purpose more than a decade ago.

Today, online data room software is more advanced than its 10-year-old versions, and that is why M&As are still the biggest use case of data room software. As a matter of fact, virtual data room providers have developed products specifically for mergers and acquisitions.

But here is the question — why should you use data room services for M&As, or what are the benefits of using data rooms in mergers or acquisitions? Read on to get your answers.

What is an M&A virtual data room?

An M&A data room software is a secure, cloud-based platform specifically designed to facilitate mergers and acquisitions, especially the due diligence process. The M&A data room is primarily used to store documents required for due diligence and inter-organizational communication.

Apart from that, VDRs have various project management tools that allow both parties to assign and manage tasks or roles during the process. However, not all virtual data room providers are good enough to carry out transactions like M&A.

Therefore, it is better to look out for data room services dedicated to M&As, specifically. To help you out, here are some of the best data rooms for M&As:

- DealRoom data rooms

- iDeals data rooms

- Merrill data rooms

- Firmex deal room

- Intralinks deal room

You can also read detailed M&A data room reviews and the due diligence document checklist on https://dataroom-providers.org/.

How does virtual data room help in M&As?

M&A virtual mainly solves two major issues:

- Inability to access due diligence documents

- Hurdles in smooth communications during the M&A process

Here is how it is done.

1. Centralized due diligence document storage

As mentioned above, the biggest issue faced by the companies during M&A due diligence is the inability to access due diligence documents at will. That mainly happens because companies have decentralized data storage systems because apart from consolidated financial statements, company branches usually maintain separate records. Some businesses still practice paper documentation systems. When business data is in dispersed form, it takes more time and effort to verify it.

Online data room software can be used as a central data repository where the seller company can temporarily store due diligence documents. This way, buyers or their representatives would be able to access required documents with ease. Another advantage of using centralized data storage in such cases is it allows the sellers to update documents in real-time.

2. Safer data sharing

Sellers or target companies are more vulnerable to data security issues in such transactions. That’s because seller companies are obligated to submit and share their financial statements, employee records, patent rights, licenses, marketing strategies, and other sensitive material. Sharing such documents over emails or other channels can be riskier for the target company.

Virtual data rooms provide highly secure and the best possible solutions for these issues, and this is the biggest reason why companies use VDRs for M&As in the first place. The seller company can upload, classify, and share documents in a controlled environment. That said, the data room administrators can:

- Restrict any user from the buyer company from accessing any document or a folder

- Set any important document on view only or fence view mode

- Revoke document access anytime

- Add or delete users at will

- Ask the buyers to sign NDAs

3. Remote access

One of the best things about virtual data rooms is the ability to access documents remotely. VDRs are cloud technology solutions that users can access from anywhere, anytime. That means the project management teams, investors, stakeholders, and other interested parties can work at their own pace and with ease.

4. Safe and quick communication

An electronic data room also serves as a communication platform during mergers and acquisitions. Data room users (buyers, sellers, and third parties) can share documents, start group discussions or Q&A sessions, and arrange meetings via audio and video conferencing tools. Q&A sessions are super helpful in M&As as both sides can ask and answer questions in real-time.

Final words

Virtual data room software is a revolutionary solution for complex deals like M&As. VDRs are effective in solving two major issues faced during mergers and acquisitions — communication and data access barriers. Most importantly, data rooms provide data security and keep things transparent during the process.

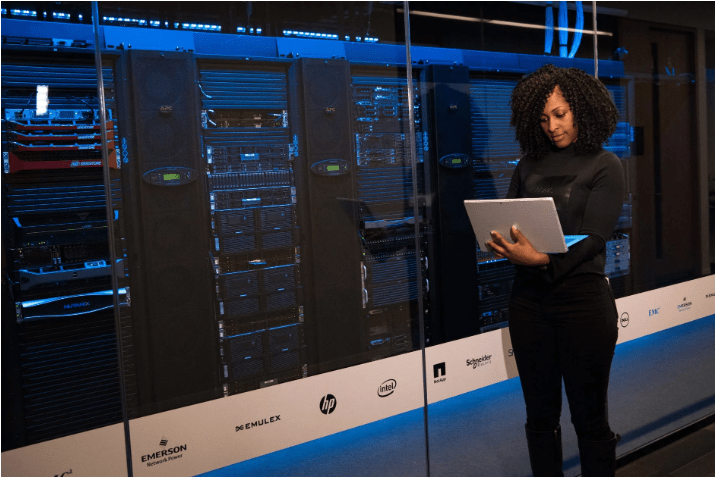

Image Credit

Virtual Data Room, via Wikimedia.

Leave a Reply

You must be logged in to post a comment.